Real Tech Fund Completes its Final Closing of Fund IV at Approximately 12.5 Billion Yen

Largest fund to date; Accelerating Social Implementation of Deep Tech Innovations Across Japan

UntroD Capital Japan K.K. (President & CEO: Akihiko Nagata, hereinafter “we” or “our company”) is pleased to announce the final closing of the Real Tech Fund IV Investment Limited Partnership (“RTF IV”), a venture capital fund specializing in seed and early-stage deep tech startups. The fund has achieved a total commitment of approximately 12.5 billion yen, making it the largest fund in our company history and positions Real Tech Fund as the largest deep tech-focused venture capital fund in Japan.

Real Tech Fund celebrates its 10th anniversary in 2025. Over the past decade, we have partnered with researchers and entrepreneurs to launch more than 100 deep tech startups, driving real-world impact and helping to address critical social challenges both in Japan and around the world.y. With the launch of RTF IV, we now embark on a new challenge—to build the foundation for the “next decade”.

Strengthening Collaboration with Regional Hubs to Foster Local Deep Tech Innovations

RTF IV enhances access to local technology seeds and support frameworks, accelerating the commercialization of high-potential deep tech innovations originating from outside metropolitan areas of Japan. We have launched our new regional bases such as “EZOHUB SAPPORO” in Hokkaido and “Fukuoka Growth Next” in Fukuoka, to identify and nurture technology seeds from these regions. Each of these hubs are led by Region Managers who actively drive stronger partnerships with universities and research institutions throughout Japan.Through these close collaboration with regional centers, we will expand the innovation ecosystem beyond Tokyo and lay the groundwork for the emergence of globally competitive startups originating from local regions.

Institutional Investors such as Japan Investment Corporation and Decarbonization Fund joining our Ecosystem

Following the second close of RTF IV in July 2024, we welcome new limited partners Japan Investment Corporation and Decarbonization Fund, a decarbonization-focused fund of funds managed by MCP Asset Management.

These new commitments—aligned with Japan’s national agendas for advancing strategic technologies and achieving a decarbonized society—underscore our ambition to grow as a leading independent venture capital fund contributing to the country’s innovation and sustainability goals.

From Local to Global: Real Tech Fund’s Track Record and Mission

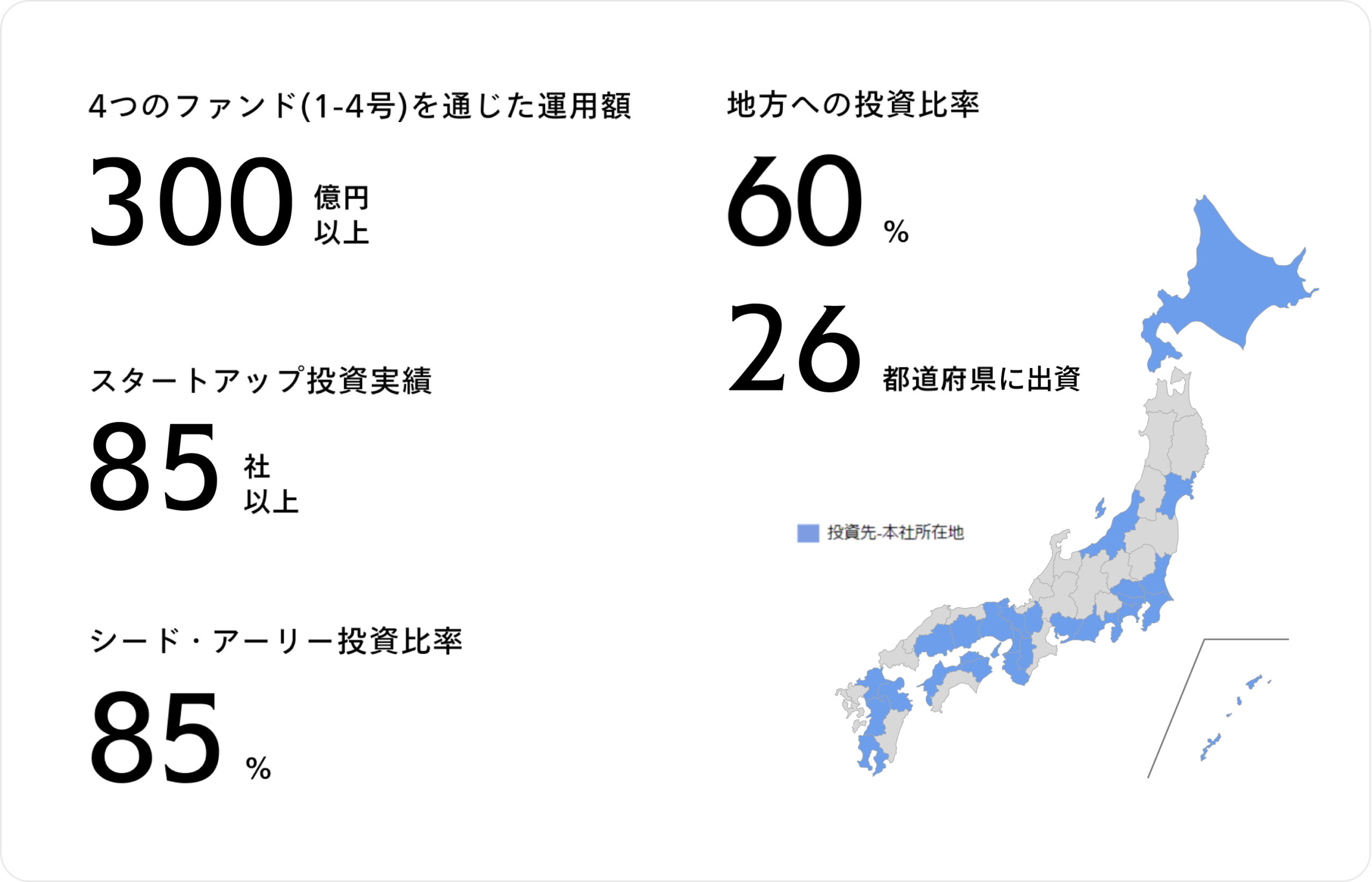

Since its establishment in 2015, Real Tech Fund has been focusing on investing in deep tech startups tackling societal challenges through cutting-edge research and technology in fields such as energy, materials, space, oceans, and biotechnology. Our mission has consistently been to drive social implementation. To date, we have invested in 85 Japanese companies across 25 prefectures, with approximately 70% originating from universities or research institutions— underscoring our role as a cornerstone supporting deep tech startups throughout Japan.

RTF IV represents both the culmination of our past 10 years of knowledge, networks, and achievements, and also the beginning of the decade ahead. Beyond capital, we have also built a robust support system through our professional team optimized for deep tech, providing hands-on assistance and strategic support for our portfolio companies to expand globally. We have also worked to build ecosystems that connect startups with large corporations, government agencies, and research institutions, establishing schemes that emphasize social implementation from the earliest stages of commercialization.

Going forward, Real Tech Fund will continue to deepen its roots in deep tech ecosystems across Japan, connect regional technologies with global societal challenges, and accelerate societal transformation through deep tech.

* Invested through a decarbonization-focused fund-of-funds managed by MCP

Overview of RTF IV

- Investment Target: Deep tech startups across Japan that aim to solve environmental and social challenges through advanced technologies

- Sectors: Bio, aerospace, electronics, agri/marine, environment/energy, new materials, etc.

- Stage: Primarily seed and early stage, with selective investments in Series A onwards

- Investment Role: Lead investor providing hands-on support

About UntroD

UntroD Inc (fka Real Tech Holdings) was established in 2015 to support deep tech startups with innovative technologies that address global societal challenges. Since then, we have been a leading investor providing hands-on support to early-stage startups. To date, we have managed Real Tech Fund 1-4 (domestic funds), Real Tech Global Fund 1-2 (global funds), and Real Tech Growth Fund 1 (domestic fund), with a total management amount exceeding ¥40 billion. In June 2024, we rebranded to “UntroD,” meaning “untrodden,” embodying our commitment to pioneering unexplored territories to prove their economic viability, thereby creating a sustainable system where capital and talent continue to flow.

Website:https://untrod.inc

Contact

UntroD Capital Japan

PR; Shinya Narita

https://untrod.inc/contact