The power of technology,

Investing in seed and early stage startups,

where capital is hard to flow,

and local deep tech startups

Investing in seed and early stage startups,

where capital is hard to flow, and local deep tech startups

Before the term “deep tech” existed, we coined the term “real tech” and ventured into uncharted territory by providing capital to research and development startups that could solve societal issues. We also supported their business growth through specialised support in intellectual property, manufacturing, recruitment, and PR, to create social impact.

New technology development is essential for treating diseases that still have no cure, curbing climate change, and freeing humans from harsh working environments. However, due to the high risks involved, there are limited players willing to invest in seed and early-stage startups that have strong core technologies but have not yet to complete MVP (minimum viable product) development and are yet to build their business models. As a lead investor, Real Tech proactively takes risks alongside startups to bring new technology seeds to the world.

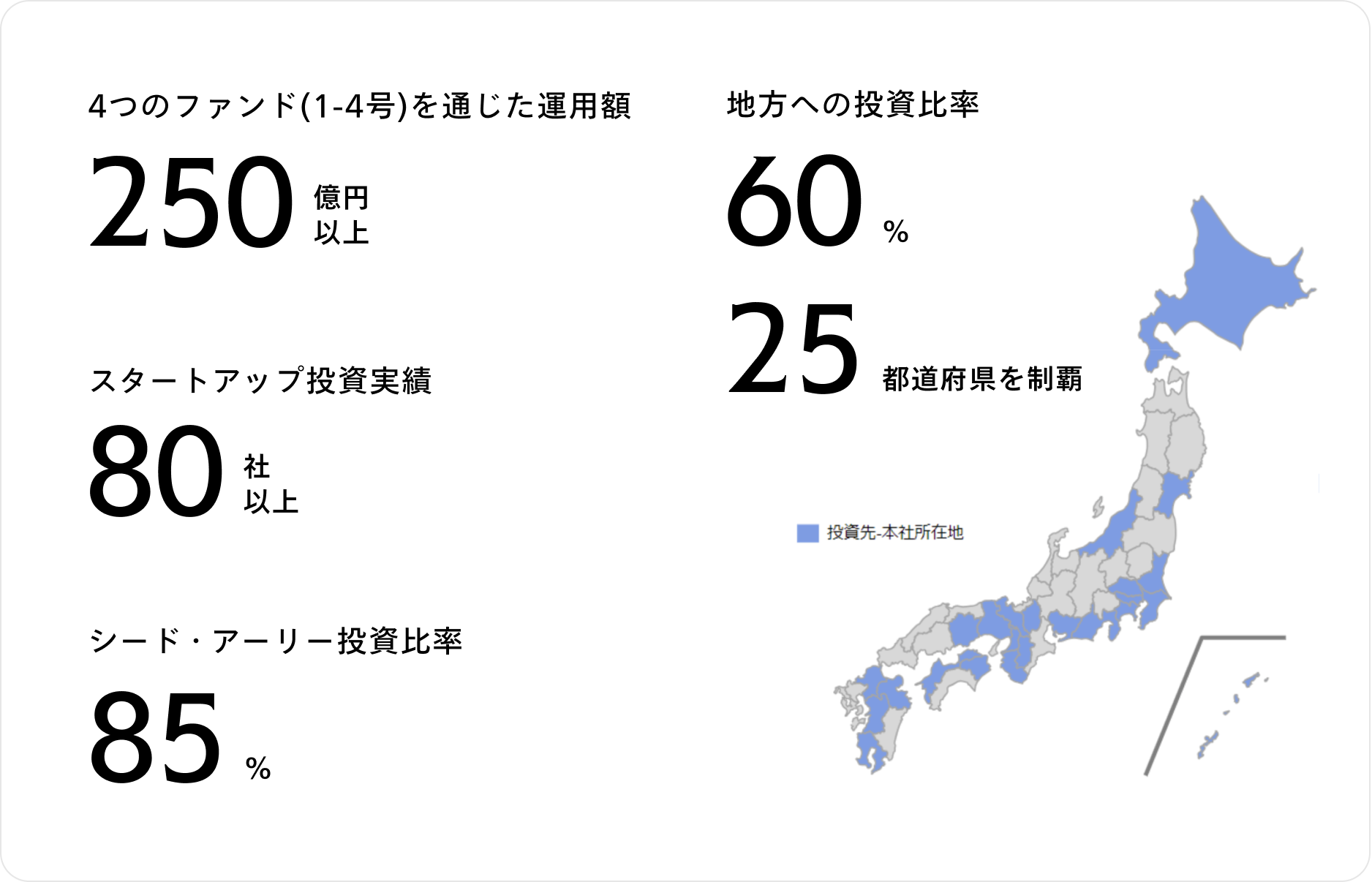

While about 80% of our venture capital investments in deep tech startups is directed towards Tokyo-based startups, more than 70% of startups are founded outside of Tokyo, and this funding supply-demand imbalance itself has become a major social issue. As deep tech startups often grow by utilising research facilities at universities and research institutions across Japan, we aim to strengthen regional ecosystems by actively investing in startups outside of Tokyo, fostering the emergence of more startups focused on solving social issues.

Our Approach

Investing in over 80 Companies Across 25 Prefectures

Since our establishment in April 2015, we have invested in and supported over 80 seed and early-stage deep tech startups, where funding is most needed.

Comprehensive and Specialised Support System for Social Implementation of Deep Tech

Comprehensive Collaboration with Leave a Nest Co., Ltd.

To discover and strengthen the support system for deep tech startups, we have a comprehensive collaboration agreement with Leave a Nest Co., Ltd., a research group with the vision of “advancing science and technology for global happiness”. They operate Asia’s largest deep tech seed acceleration program, “TECH PLANTER,” the “HYPER INTERDISCIPLINARY CONFERENCE” that fosters new knowledge by transcending boundaries of different fields and industries, and the “Knowledge Manufacturing Conference”, which combines knowledge across fields and industries between SMEs and startups. This collaboration builds a support system from discovering technical seeds globally to supporting startups and leading investments and development at the seed and early stages.

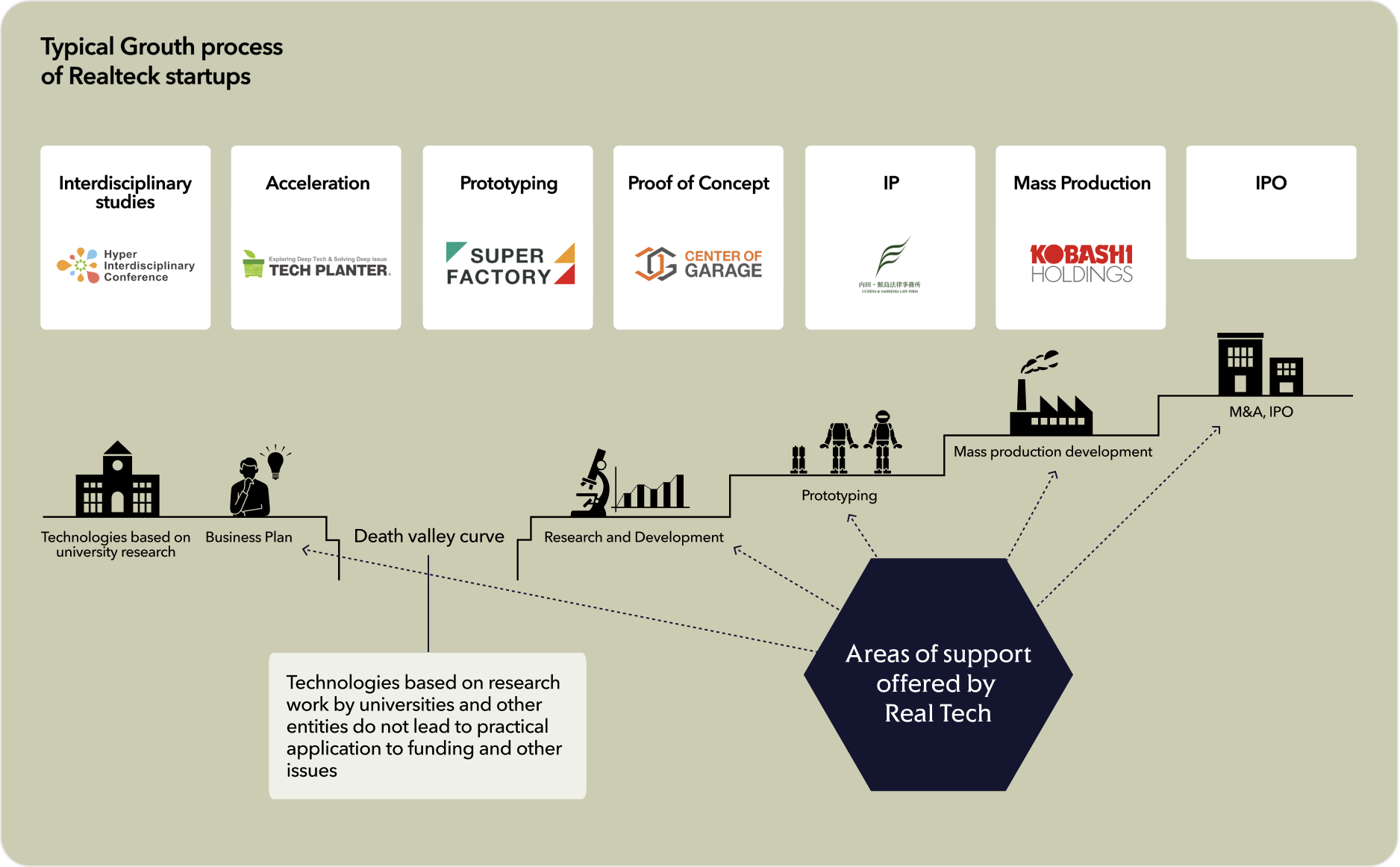

An Ecosystem to Seamlessly Support Deep Tech Social Implementation

To realise an ecosystem that provides seamless support for the social implementation of deep tech startups, we have partnered with a variety of companies, including Leave a Nest Co., Ltd., Uchida & Samejima Law Firm, which offers legal services in the deep tech field, and KOBASHI HOLDINGS Co., Ltd., which has a history of manufacturing over 100 years under the philosophy of “cultivating the Earth.” This collaboration has established an ecosystem that provides comprehensive support, from discovering technical seeds, incubation to prototyping, POC, IP strategy, scale production, and IPO, overcoming various barriers at each growth stage.

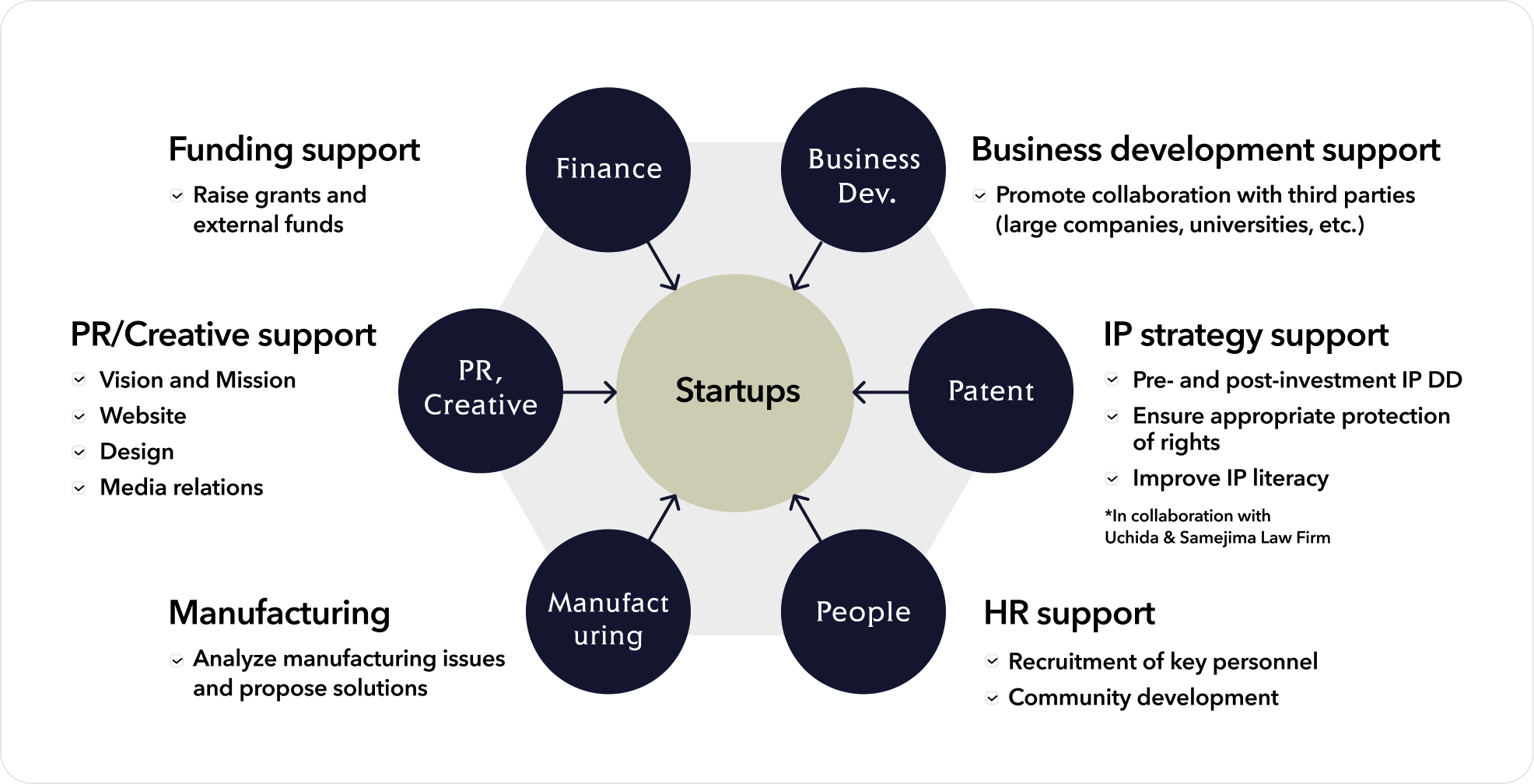

A Professional Team Optimised for the Deep Tech Domain

UntroD has assembled a professional team capable of providing optimal support in the deep tech domain. In addition to funding and business support, we offer hands-on support in various functional areas, including intellectual property, recruitment and HR, public relations, creative, and manufacturing.

Extensive Network of Business Corporations

The companies investing in the Real Tech Fund comprise experts from various industries aiming to collaborate with deep tech startups. At UntroD, we support the realization of business and capital collaborations.

Companies investing in either Japan or Global funds

Companies investing in either Japan or Global funds

People

-

Akihiko Nagata

UntroD Capital Japan,Inc.

CEO -

Yukihiro Maru

UntroD, Inc. / UntroD Capital Asia Pte. Ltd.

Managing Director

Ph.D. -

Akitaka Wilhelm Fujii

UntroD Capital Japan,Inc. / UntroD Capital Asia Pte. Ltd.

Executive Director -

Sou Yanbe

UntroD Capital Japan,Inc.

Executive Director -

Naoki Higashizono

UntroD Capital Japan,Inc. Executive Director

UntroD Bridge Capital,Inc. Managing Director -

Satoshi Uejima

UntroD Capital Japan,Inc.

Executive Director -

Fumiharu Muroga

UntroD Capital Japan,Inc.

Growth Manager -

Mizuki Komasa

UntroD Capital Japan,Inc.

Growth Manager -

Taro Kinoshita

UntroD Capital Japan,Inc.

Growth Manager -

Hiromi Wendy Hiraizumi

UntroD Capital Japan,Inc.

Growth Manager -

Yoshifumi Nishita

UntroD Capital Japan,Inc.

Fund Manager -

Yuki Tazaki

UntroD Capital Japan,Inc.

Envision Manager -

Shinya Narita

UntroD Capital Japan,Inc.

Envision Manager -

Masayuki Maruyama

UntroD Capital Japan,Inc.

Patent Manager -

Saki Torii

UntroD Capital Japan,Inc.

Administration Manager

Portfolio

Real Tech Fund focuses on addressing serious societal challenges, contributing to solutions for the earth and humanity by supporting investments in deep-tech startups with technologies aimed at resolving these issues.

-

Decarbonization of Energy

By supporting investments in startups with renewable energy technology and energy efficiency solutions, we promote the decarbonization of energy. This contributes to ensuring sustainable energy supply, reducing greenhouse gas emissions, and addressing global climate change.

-

Decarbonization of Industry

We focus on technologies that support carbon dioxide emissions reduction in the industrial sector, investing in startups advancing clean technologies and energy efficiency. This promotes a circular economy and decarbonizes production processes, enhancing industrial sustainability.

-

Food issues

To address global food supply issues, we support investments in startups with sustainable agriculture technology and food tech. By aiding improvements in food production efficiency and reducing food loss, we contribute to food security and reduced environmental impact.

-

Transport & Infrastructure

We invest in startups offering environmentally friendly transportation solutions and infrastructure technology to support sustainable infrastructure development. By encouraging the adoption of groundbreaking electric vehicles and next-generation transportation systems, we reduce environmental impact and improve transportation efficiency.

-

Medical and Healthcare Issues

By investing in startups in medical innovation, drug discovery, and telemedicine, we support the spread of advanced medical solutions, contributing to extended healthy lifespans, optimized medical resources, improved healthcare access, and enhanced quality of medical services.

-

Aging Population

To address the challenges of an aging society, we invest in startups with caregiving technology and solutions to support the workforce. These efforts aim to solve issues faced by facilities and medical fields struggling with increasing numbers of the disabled and elderly, as well as labor shortages, thus contributing to a sustainable social security system and community revitalization.

View More

News

-

2025.6.17

- #Corporate

- #Japan-fund

Real Tech Fund Completes its Final Closing of Fund IV at Approximately 12.5 Billion YenLargest fund to date; Accelerating Social Implementation of Deep Tech Innovations Across Japan -

2024.7.10

- #

Real Tech Fund invests in Material Gate, which is a startup from Hiroshima University, to solve high power consumption issues with innovative memory materials -

2024.7.08

- #Corporate

- #

Real Tech Fund Completes Second Close of 4th FundMany Existing Fund Partners Continue Their Commitment -

2024.6.10

- #Corporate

- #

UntroD Capital Japan and Leave a Nest Enter Comprehensive Partnership AgreementStrengthening the Support System for Discovering and Nurturing Deep Tech Startups in Japan -

2024.6.03

- #Corporate

- #

- #

Real Tech Holdings Relaunches as “UntroD”─ Expanding from Deep Tech Focus to Uncharted Social Impact ─

View More

Fund managed by UntroD Group

-

REAL TECH FUND Japan

We invest in seed and early-stage deep tech startups throughout Japan and provide comprehensive business growth support.

View more

-

REAL TECH FUND Global

Aiming to solve environmental and social issues in Southeast Asia and beyond, we invest in deep tech startups and strive to significantly scale their businesses globally by leveraging Japan's manufacturing know-how, access to a large pool of capital, as well as the significant growth potential of developing markets.

View more

-

Crossover Impact Fund

We provide long-term funding to promising late-stage startups that aim for impact-oriented IPOs tied to solving social issues. We emphasise sustainable growth post-listing and support the enhancement of corporate value.

View more