UntroD Capital Asia Backs Q5D’s Next-Gen Wiring Automation to Drive Sustainable, Resilient Manufacturing in Asia

UntroD Capital Asia announced its participation in Q5D’s $13.5 million Series A financing round—co-led by Lockheed Martin Ventures alongside Chrysalix, Maven Capital—to tackle one of manufacturing’s last manual frontiers: wiring harness assembly. In an era defined by electrification, harnesses remain labor-intensive commodities, typically assembled on pin-boards by semi-skilled workers in low-cost regions. This long-outdated approach drives up costs, prolongs global supply chains, and jeopardizes consistent quality and sustainability as demand for EVs and electronic devices soars.

On-demand & precision production

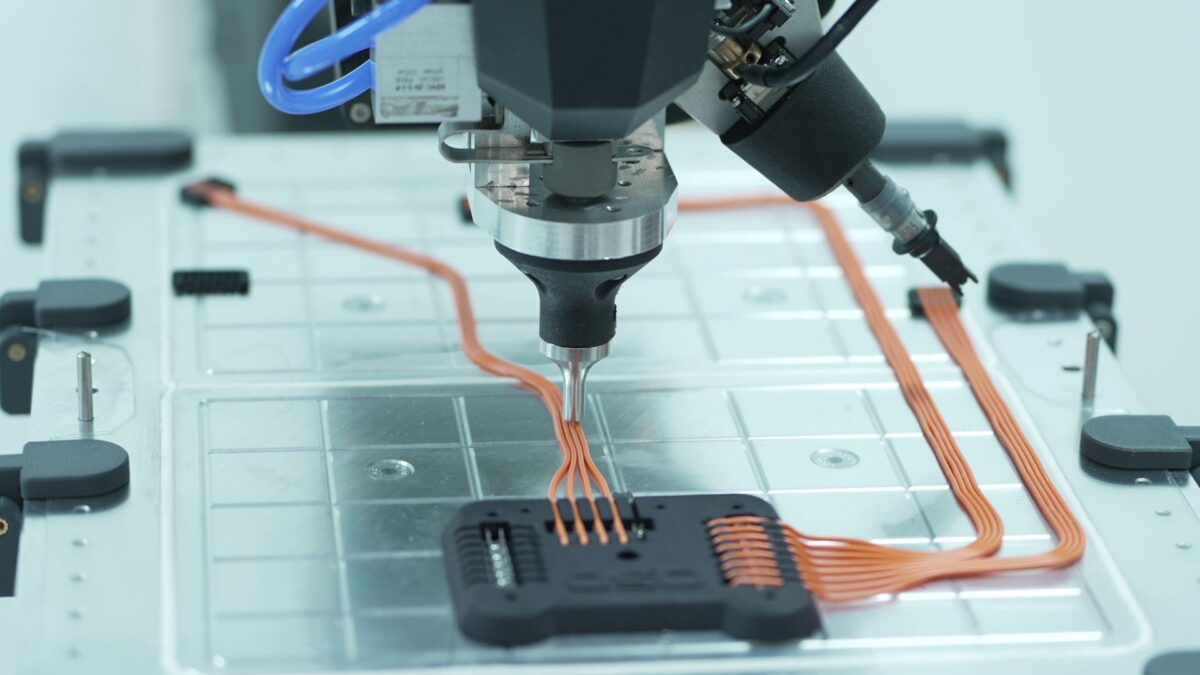

Q5D’s 5-axis robotic cells blend advanced control software with innovative additive formulations to fabricate wiring harnesses exactly when and where they are needed. By embedding conductive pathways directly into components such as headliners, door panels, and bumpers, the system slashes assembly errors and scrap while eliminating the carbon footprint of long-distance shipping and excess warehousing. The result is a lean, green manufacturing model that delivers consistently high-quality parts on demand, freeing up floor space and driving down both emissions and costs.

Reinforced supply chain resilience

On-shoring harness production in key automotive hubs empowers OEMs to sidestep geopolitical turbulence and logistics bottlenecks. Localized robotic lines give manufacturers end-to-end control over scheduling, quality standards, and delivery times—ensuring uninterrupted output even when global freight lanes or trade policies shift unexpectedly. By bringing wiring automation closer to final assembly, Q5D’s solution builds a more agile, reliable, and sustainable supply chain.

Commercial Rollout & UntroD’s Support

Pilots at Q5D’s Bristol Technical Assessment Centre are already generating valuable data with leading automotive OEMs and Tier 1 suppliers. UntroD Capital Asia will harness its deep Asia-Pacific network—particularly within Japan’s automotive ecosystem—to accelerate these trials into full-scale deployments through targeted commercial introductions, joint development agreements, and collaborative innovation workshops. This Series A funding will support Q5D’s next phase of growth—expanding its engineering and operations teams, adding manufacturing cells, and forging the partnerships needed to bring automated wiring into mass production. Q5D also anticipates a further corporate investment round later this year to fuel its global expansion.

“Q5D represents a rare entrepreneurial venture with truly global ambitions and a strong Japan focus,” said Henry Tao, Director at UntroD Capital Asia. “Their pragmatic, step-wise platform automates the embedding of conductive paths into headliners, seating, door panels and more— letting OEMs integrate advanced electrification while reducing supply chain complexity. By localizing production in global automotive hubs, especially amid Japanese Tier 1 partners, Q5D will reduce CO₂ from long-distance logistics, eliminate inventory waste, and strengthen regional supply-chain resilience.”

About Q5D

Based in Bristol, UK, Q5D manufactures 5-axis robotic platforms. These automate the installation of electrical wiring into products, eliminating the need for conventional wiring harnesses. The processes reduce cost, weight, and complexity in automotive, aerospace, and consumer products. They boost manufacturing productivity by up to 10X, improve product reliability, and simplify supply chains. For more information, visit

https://q5d.com.

About UntroD Capital Asia

UntroD Capital Asia is a leading deep-tech VC firm dedicated to fostering impactful technologies that drive sustainable growth. As the manager of the Real Tech Global Funds, UntroD Capital Asia partners with innovative startups and businesses addressing global challenges in sectors such as energy transition, sustainable agri-food, and industrial manufacturing. UntroD’s hands-on approach and industry network provide portfolio companies with the resources and expertise needed to scale their operations and achieve lasting impact.